- Nickel: resource distribution and production

- World Resources: Identified land-based resources averaging 1% nickel or greater contain at least 130 million tons of nickel. About 60% is in laterites and 40% is in sulfide deposits. Extensive resources of nickel are also found in manganese crusts and nodules covering large areas of the ocean floor.

- Source: Nickel-U.S. Geological Survey, Mineral Commodity Summaries, February 2014

- Distribution according to region

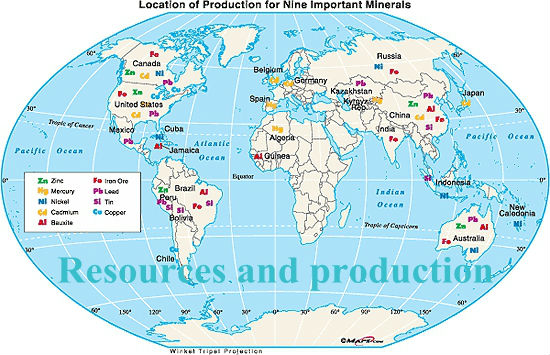

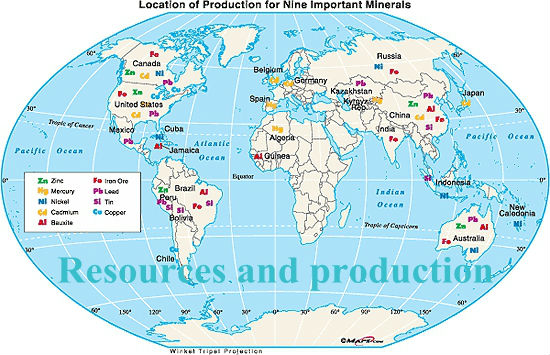

Laterite-nickel ore: New Caledonia in the south Pacific Ocean; Moluccas and Sulawesi in Indonesia; Palawan in the Philippines; Queensland in Australia; Minas Gerais and Goias in Brazil; Oriente in Cuba; Banan in Dominica; the Central Euboea area, Neo Kokkino area of Viotia, and Kastoria area in Greece; and some other areas in Russia and Albania, etc.

Laterite-nickel ore: New Caledonia in the south Pacific Ocean; Moluccas and Sulawesi in Indonesia; Palawan in the Philippines; Queensland in Australia; Minas Gerais and Goias in Brazil; Oriente in Cuba; Banan in Dominica; the Central Euboea area, Neo Kokkino area of Viotia, and Kastoria area in Greece; and some other areas in Russia and Albania, etc. Nickel sulphide ore: Jinchuan, Gansu Province and Panshi, Jilin Province in China; Sudbury, Ontario Province and Lynn Lake-Thompson, Manitoba Province in Canada; Kola Peninsula and Norilsk, Siberia, in Russia; Kambalda in Australia; Selebi Phikwe in Botswana; Kotalahti in Finland.

Nickel sulphide ore: Jinchuan, Gansu Province and Panshi, Jilin Province in China; Sudbury, Ontario Province and Lynn Lake-Thompson, Manitoba Province in Canada; Kola Peninsula and Norilsk, Siberia, in Russia; Kambalda in Australia; Selebi Phikwe in Botswana; Kotalahti in Finland.- Distribution according to country

- Laterite-Nickel Ore: Cuba, New Caledonia, Indonesia, Philippines, Burma, Vietnam and Brazil.

- Nickel Sulphide ore: Canada, Russia, Australia, China and South Africa, etc.

- Major nickel producing countries: Indonesia, Russia, China, Canada, Cuba, Australia, Philippines, New Caledonia.

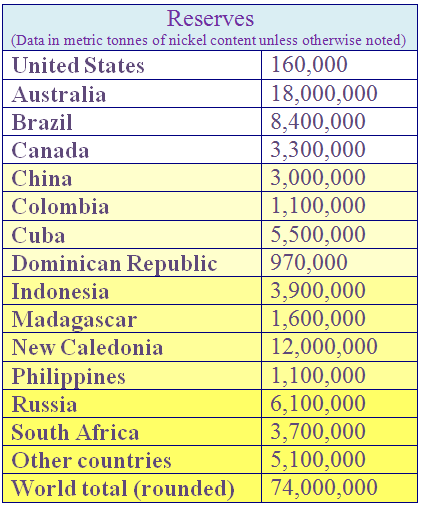

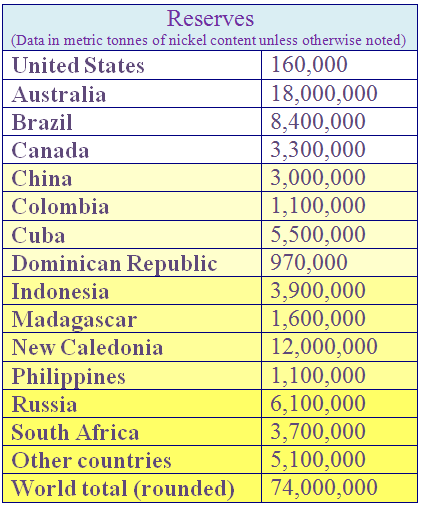

- The figures of nickel reserves reported by the United States Geological Survey (USGS) in 2014 were as follows:

-

- Source: Nickel- U.S. Geological Survey, Mineral Commodity Summaries, February 2014

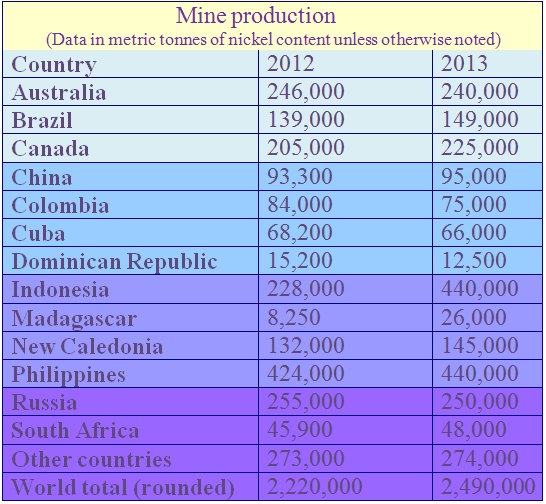

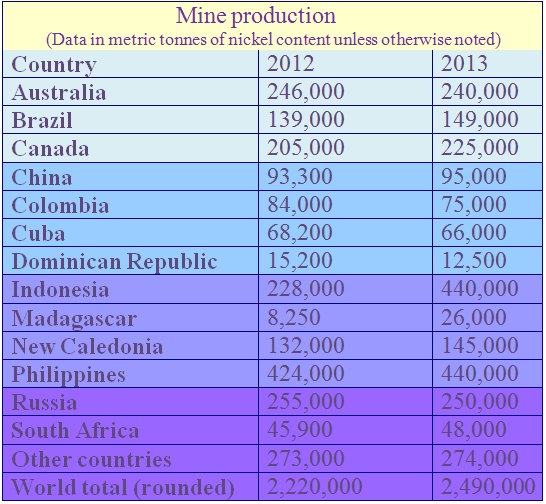

- The figures of nickel mine production reported by the United States Geological Survey (USGS) in 2014 were as follows:

- Source: Nickel- U.S. Geological Survey, Mineral Commodity Summaries, February 2014

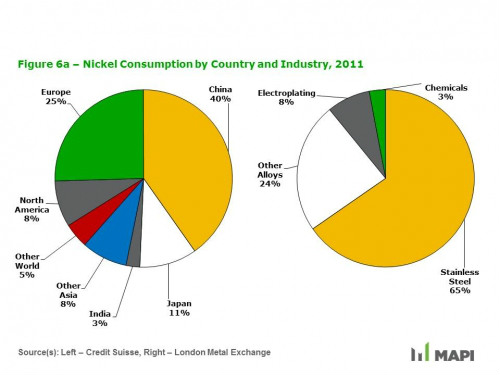

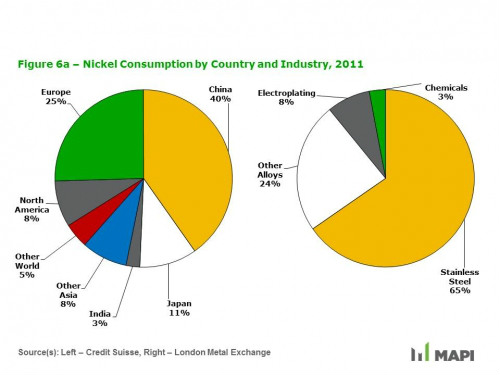

- Nickel consumption by country and industry, 2011 were as follows:

- In 2012, the slowdown in demand for nickel was especially apparent compared with other base metals, thanks mainly to the moderation in stainless steel production, which accounts for about two-thirds of global usage. Consumption is forecast to have slowed from a 7 percent growth rate in 2011 to 2 percent in 2012, and to increase 4 percent in 2013, underpinned by the recovery in demand from the EU, South Korea, and India. The medium-term consumption outlook is still promising considering emerging markets’ low per capita nickel consumption and ongoing industrialization and urbanization. Consumption in China, however, is expected to moderate significantly from the annual growth rate of 21 percent during 2006-10; the focus of its steel industry is shifting from expanding capacity to improving quality and product range.

- Source: Nickel Consumption by Country and Industry-MAPI

- Leading nickel consumers in 2011 were as follows:

- Source: http://ar11.angloamerican.com/ofr/business_unit-nickel.aspx

-

About us

Contact us

Make a suggestion

- Metalpedia is a non-profit website, aiming to broaden metal knowledge and provide extensive reference database to users. It provides users reliable information and knowledge to the greatest extent. If there is any copyright violation, please notify us through our contact details to delete such infringement content promptly.

Laterite-nickel ore: New Caledonia in the south Pacific Ocean; Moluccas and Sulawesi in Indonesia; Palawan in the Philippines; Queensland in Australia; Minas Gerais and Goias in Brazil; Oriente in Cuba; Banan in Dominica; the Central Euboea area, Neo Kokkino area of Viotia, and Kastoria area in Greece; and some other areas in Russia and Albania, etc.

Laterite-nickel ore: New Caledonia in the south Pacific Ocean; Moluccas and Sulawesi in Indonesia; Palawan in the Philippines; Queensland in Australia; Minas Gerais and Goias in Brazil; Oriente in Cuba; Banan in Dominica; the Central Euboea area, Neo Kokkino area of Viotia, and Kastoria area in Greece; and some other areas in Russia and Albania, etc. Nickel sulphide ore: Jinchuan, Gansu Province and Panshi, Jilin Province in China; Sudbury, Ontario Province and Lynn Lake-Thompson, Manitoba Province in Canada; Kola Peninsula and Norilsk, Siberia, in Russia; Kambalda in Australia; Selebi Phikwe in Botswana; Kotalahti in Finland.

Nickel sulphide ore: Jinchuan, Gansu Province and Panshi, Jilin Province in China; Sudbury, Ontario Province and Lynn Lake-Thompson, Manitoba Province in Canada; Kola Peninsula and Norilsk, Siberia, in Russia; Kambalda in Australia; Selebi Phikwe in Botswana; Kotalahti in Finland.