- Magnesium resources, reserves and production

- Magnesium is found in seawater and brines, as well as in deposits in the earth. There are three different types of magnesium ore: magnesite, dolomite and carnallite. It is also found in salt wells, brine and seawater. Traces of the element can be found in mineral waters. The element is a part of green plant chlorophyll.

Resources from which magnesium may be recovered range from large to virtually unlimited and are globally widespread. Resources of dolomite and magnesium-bearing evaporite minerals are enormous. Magnesium-bearing brines are estimated to constitute a resource in the billions of tons, and magnesium can be recovered from seawater at many places along the world's coastlines.

Resources from which magnesium may be recovered range from large to virtually unlimited and are globally widespread. Resources of dolomite and magnesium-bearing evaporite minerals are enormous. Magnesium-bearing brines are estimated to constitute a resource in the billions of tons, and magnesium can be recovered from seawater at many places along the world's coastlines.

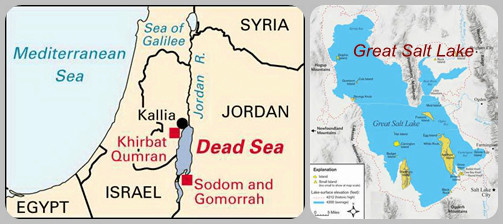

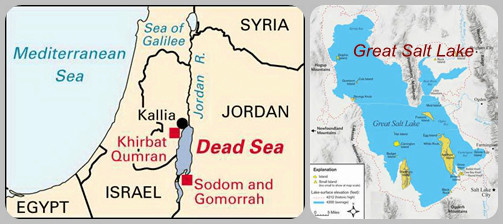

- However, magnesium reserves are highly concentrated in three countries: Russia, China and Korea. Magnesite is the major source from which China extracts magnesium. In 2013, identified world resources of magnesite totaled 12 billion tones and world reserves of magnesite totaled 2.4 billion tones with China accounting for 21% (500 million tonnes), Russia accounting for 27% (650 million tonnes) and North Korea accounting for 18.8% (450 million tonnes). In addition to magnesite, there are vast reserves of well and lake brines and seawater from which magnesium compounds can be recovered. The Dead Sea and the Great Salt Lake in Utah, US are abundant in magnesium resources and famous around the world.

Australia has a recoverable resource of 202Mt of magnesium ore. All deposits are exploited as open cut mines and most are found in South Australia, followed by Queensland, then Tasmania. Queensland Magnesia (QMAG) exploits the Kunwarara deposit, where mining commenced in 1989. Proven resources are in excess of 87 million tonnes of ore. Orind Australia owns the Thuddungra magnesite deposit in New South Wales. Orind is ultimately owned by Excel Colours & Frits, an India-based company.

Australia has a recoverable resource of 202Mt of magnesium ore. All deposits are exploited as open cut mines and most are found in South Australia, followed by Queensland, then Tasmania. Queensland Magnesia (QMAG) exploits the Kunwarara deposit, where mining commenced in 1989. Proven resources are in excess of 87 million tonnes of ore. Orind Australia owns the Thuddungra magnesite deposit in New South Wales. Orind is ultimately owned by Excel Colours & Frits, an India-based company.  Dead Sea Magnesium, a 65/35 joint venture between Israel Chemicals Ltd and Volkswagen AG, has been producing magnesium metal since 1996 from the waters of the Dead Sea. This lake is a replenishable source of magnesium, sodium, potassium, chlorides and bromides, from which potash, bromine, magnesium chloride and periclase (another magnesium compound) are produced, as well as magnesium metal.

Dead Sea Magnesium, a 65/35 joint venture between Israel Chemicals Ltd and Volkswagen AG, has been producing magnesium metal since 1996 from the waters of the Dead Sea. This lake is a replenishable source of magnesium, sodium, potassium, chlorides and bromides, from which potash, bromine, magnesium chloride and periclase (another magnesium compound) are produced, as well as magnesium metal. In the United States, US Magnesium is the sole producer of primary magnesium, having used the Great Salt Lake as its resource since 1972.

In the United States, US Magnesium is the sole producer of primary magnesium, having used the Great Salt Lake as its resource since 1972. In Canada, Gossan Resources is advancing the Inwood magnesium project, which contains large deposits of high-grade dolomite and silica sand, both used in magnesium metal production. Inwood holds a measured resource of at least 34.8Mt and an inferred resource of 132Mt.

In Canada, Gossan Resources is advancing the Inwood magnesium project, which contains large deposits of high-grade dolomite and silica sand, both used in magnesium metal production. Inwood holds a measured resource of at least 34.8Mt and an inferred resource of 132Mt.

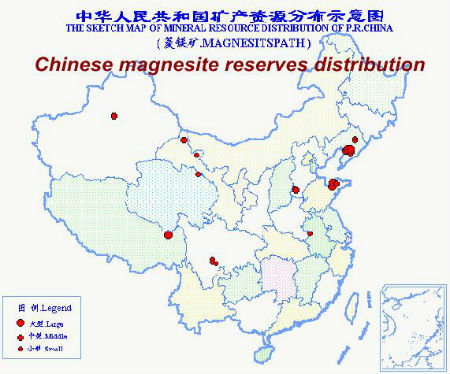

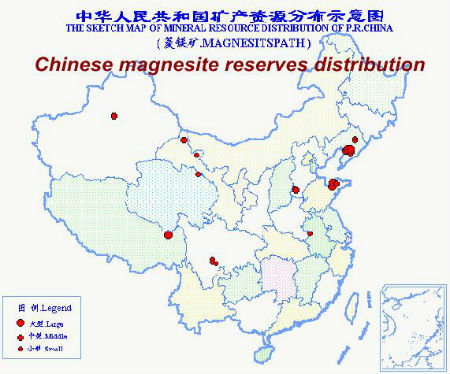

- China is the country with the second most abundant magnesite resources. There are 27 proven magnesite deposits in China, and these are mainly distributed in Liaoning, Shandong (a minimum verified reserve of 350 million tonnes), Xinjiang, Tibet and Gansu, among which, the reserves in Liaoning, are the largest, accounting for about 85.6% of those in China overall, and the area is world famous for its large reserves and high quality.

- Dolomite mines are rich in China as well, mainly being distributed in Shanxi, Henan, Jilin and Qinghai provinces. There are nearly 4 billion tones of identified reserves in China.

- Magnesium salt is abundant in Qaidam Basin in China, and nearly 99% of identified magnesium salt reserves are found in that area. There are two types: magnesium chloride (identified reserve 4.2 billion tonnes, base reserve 1.9 billion tonnes); and magnesium sulfate (identified reserve 1.7 billion tonnes, base reserve 1.2 billion tonnes).

- According to the latest data released by USGS, in 2013, world magnesite mine production fell to 5.96 million tonnes with a year-on-year decrease of 390 tones. China tops the world magnesite productions, accounting for 57% of the total amount.

- Today almost all the world's primary magnesium is produced in China, which was responsible for 800,000 tonnes out of a total world production of 910,000 tonnes in 2013. Other significant producers of magnesium metal are Russia, Israel and Kazakhstan, which smaller quantities are produced in Canada, Brazil, Serbia and Ukraine.

- Today China remains the largest magnesium manufacturer with an 81% share of world output. The USA produces 5.1% of all magnesium. (Data from Merchant Research & Consulting ltd)

- According to the International Magnesium Conference data, China's reported magnesium production was 698,300 tons in 2012, 5.71% higher than it was in 2011, and accounting for 82% of world output. By 2012, China had topped world production for 15 years. Forty-four percent of the output was from Shaanxi Province (3,167,000 tons), 42.48% from Shanxi Province, and 5% from Ningxia Province. Production has shifted from Shanxi Province to Shaanxi Province because of lower energy costs.

- Famous magnesium producers in China

Shanxi Yinguang Magnesium Industry (Group) Co., Ltd. is the largest primary magnesium producer in China, with a primary magnesium capacity of 100 kilotons in 2012. Its major subsidiary Shanxi Yinguang Huasheng Magnesium Industry Co., Ltd. ranked No.1 in China in terms of primary magnesium output in 2011. At present, the company has formed a complete industrial chain covering every stage from magnesium ore exploitation to magnesium alloy deep processing.

Shanxi Yinguang Magnesium Industry (Group) Co., Ltd. is the largest primary magnesium producer in China, with a primary magnesium capacity of 100 kilotons in 2012. Its major subsidiary Shanxi Yinguang Huasheng Magnesium Industry Co., Ltd. ranked No.1 in China in terms of primary magnesium output in 2011. At present, the company has formed a complete industrial chain covering every stage from magnesium ore exploitation to magnesium alloy deep processing.  Nanjing Yunhai Special Metals Co., Ltd. is the largest producer of magnesium alloys in China, with a magnesium alloy capacity of 140 kilotons in 2012. The company has significant competitive advantages in China’s magnesium alloy market, and has occupied the largest market share for years. At present, the company is accelerating its magnesium alloy capacity expansion, and developing the upstream industrial chain in the regions with rich magnesium ore resources such as Shanxi Province.

Nanjing Yunhai Special Metals Co., Ltd. is the largest producer of magnesium alloys in China, with a magnesium alloy capacity of 140 kilotons in 2012. The company has significant competitive advantages in China’s magnesium alloy market, and has occupied the largest market share for years. At present, the company is accelerating its magnesium alloy capacity expansion, and developing the upstream industrial chain in the regions with rich magnesium ore resources such as Shanxi Province.  Dongguan Eontec Co., Ltd. is a major manufacturer of magnesium alloy precision die castings in China. It went public on the GEM of the Shenzhen Stock Exchange in 2012. In recent years, its revenue from magnesium alloy products has maintained rapid growth. It’s accelerating the strategic switch to 3C products, and the magnesium alloy shells and internal brackets for tablet PCs and smart phones will be the main business growth points for the company in the future.

Dongguan Eontec Co., Ltd. is a major manufacturer of magnesium alloy precision die castings in China. It went public on the GEM of the Shenzhen Stock Exchange in 2012. In recent years, its revenue from magnesium alloy products has maintained rapid growth. It’s accelerating the strategic switch to 3C products, and the magnesium alloy shells and internal brackets for tablet PCs and smart phones will be the main business growth points for the company in the future.

-

About us

Contact us

Make a suggestion

- Metalpedia is a non-profit website, aiming to broaden metal knowledge and provide extensive reference database to users. It provides users reliable information and knowledge to the greatest extent. If there is any copyright violation, please notify us through our contact details to delete such infringement content promptly.

Resources from which magnesium may be recovered range from large to virtually unlimited and are globally widespread. Resources of dolomite and magnesium-bearing evaporite minerals are enormous. Magnesium-bearing brines are estimated to constitute a resource in the billions of tons, and magnesium can be recovered from seawater at many places along the world's coastlines.

Resources from which magnesium may be recovered range from large to virtually unlimited and are globally widespread. Resources of dolomite and magnesium-bearing evaporite minerals are enormous. Magnesium-bearing brines are estimated to constitute a resource in the billions of tons, and magnesium can be recovered from seawater at many places along the world's coastlines.

Australia has a recoverable resource of 202Mt of magnesium ore. All deposits are exploited as open cut mines and most are found in South Australia, followed by Queensland, then Tasmania. Queensland Magnesia (QMAG) exploits the Kunwarara deposit, where mining commenced in 1989. Proven resources are in excess of 87 million tonnes of ore. Orind Australia owns the Thuddungra magnesite deposit in New South Wales. Orind is ultimately owned by Excel Colours & Frits, an India-based company.

Australia has a recoverable resource of 202Mt of magnesium ore. All deposits are exploited as open cut mines and most are found in South Australia, followed by Queensland, then Tasmania. Queensland Magnesia (QMAG) exploits the Kunwarara deposit, where mining commenced in 1989. Proven resources are in excess of 87 million tonnes of ore. Orind Australia owns the Thuddungra magnesite deposit in New South Wales. Orind is ultimately owned by Excel Colours & Frits, an India-based company.  Dead Sea Magnesium, a 65/35 joint venture between Israel Chemicals Ltd and Volkswagen AG, has been producing magnesium metal since 1996 from the waters of the Dead Sea. This lake is a replenishable source of magnesium, sodium, potassium, chlorides and bromides, from which potash, bromine, magnesium chloride and periclase (another magnesium compound) are produced, as well as magnesium metal.

Dead Sea Magnesium, a 65/35 joint venture between Israel Chemicals Ltd and Volkswagen AG, has been producing magnesium metal since 1996 from the waters of the Dead Sea. This lake is a replenishable source of magnesium, sodium, potassium, chlorides and bromides, from which potash, bromine, magnesium chloride and periclase (another magnesium compound) are produced, as well as magnesium metal. In the United States, US Magnesium is the sole producer of primary magnesium, having used the Great Salt Lake as its resource since 1972.

In the United States, US Magnesium is the sole producer of primary magnesium, having used the Great Salt Lake as its resource since 1972. In Canada, Gossan Resources is advancing the Inwood magnesium project, which contains large deposits of high-grade dolomite and silica sand, both used in magnesium metal production. Inwood holds a measured resource of at least 34.8Mt and an inferred resource of 132Mt.

In Canada, Gossan Resources is advancing the Inwood magnesium project, which contains large deposits of high-grade dolomite and silica sand, both used in magnesium metal production. Inwood holds a measured resource of at least 34.8Mt and an inferred resource of 132Mt.

Shanxi Yinguang Magnesium Industry (Group) Co., Ltd. is the largest primary magnesium producer in China, with a primary magnesium capacity of 100 kilotons in 2012. Its major subsidiary Shanxi Yinguang Huasheng Magnesium Industry Co., Ltd. ranked No.1 in China in terms of primary magnesium output in 2011. At present, the company has formed a complete industrial chain covering every stage from magnesium ore exploitation to magnesium alloy deep processing.

Shanxi Yinguang Magnesium Industry (Group) Co., Ltd. is the largest primary magnesium producer in China, with a primary magnesium capacity of 100 kilotons in 2012. Its major subsidiary Shanxi Yinguang Huasheng Magnesium Industry Co., Ltd. ranked No.1 in China in terms of primary magnesium output in 2011. At present, the company has formed a complete industrial chain covering every stage from magnesium ore exploitation to magnesium alloy deep processing.  Nanjing Yunhai Special Metals Co., Ltd. is the largest producer of magnesium alloys in China, with a magnesium alloy capacity of 140 kilotons in 2012. The company has significant competitive advantages in China’s magnesium alloy market, and has occupied the largest market share for years. At present, the company is accelerating its magnesium alloy capacity expansion, and developing the upstream industrial chain in the regions with rich magnesium ore resources such as Shanxi Province.

Nanjing Yunhai Special Metals Co., Ltd. is the largest producer of magnesium alloys in China, with a magnesium alloy capacity of 140 kilotons in 2012. The company has significant competitive advantages in China’s magnesium alloy market, and has occupied the largest market share for years. At present, the company is accelerating its magnesium alloy capacity expansion, and developing the upstream industrial chain in the regions with rich magnesium ore resources such as Shanxi Province.  Dongguan Eontec Co., Ltd. is a major manufacturer of magnesium alloy precision die castings in China. It went public on the GEM of the Shenzhen Stock Exchange in 2012. In recent years, its revenue from magnesium alloy products has maintained rapid growth. It’s accelerating the strategic switch to 3C products, and the magnesium alloy shells and internal brackets for tablet PCs and smart phones will be the main business growth points for the company in the future.

Dongguan Eontec Co., Ltd. is a major manufacturer of magnesium alloy precision die castings in China. It went public on the GEM of the Shenzhen Stock Exchange in 2012. In recent years, its revenue from magnesium alloy products has maintained rapid growth. It’s accelerating the strategic switch to 3C products, and the magnesium alloy shells and internal brackets for tablet PCs and smart phones will be the main business growth points for the company in the future.