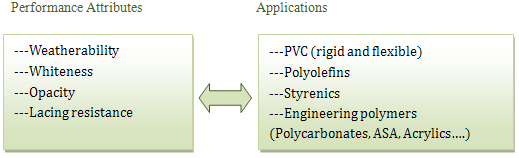

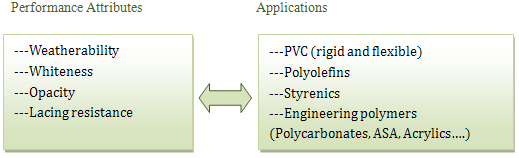

Titanium dioxide pigment (chemical symbol: TiO2) is an inorganic white pigment founded in a variety of end-uses, including paints (50%+ of global production), plastics (30%), and papers (5%). TiO2 possesses unique opacity and brightness characteristics with no cost-effective known replacement. Right now, TiO2 is the world’s most widely used white pigment accounting for more than 80 percent of global consumption.

Titanium dioxide pigment (chemical symbol: TiO2) is an inorganic white pigment founded in a variety of end-uses, including paints (50%+ of global production), plastics (30%), and papers (5%). TiO2 possesses unique opacity and brightness characteristics with no cost-effective known replacement. Right now, TiO2 is the world’s most widely used white pigment accounting for more than 80 percent of global consumption.

Titanium Dioxide is used to impart a whiteness to color cosmetics and personal care products that are applied to the skin (including the eye area), nails and lips, which it also helps to increase the opacity, and reduce the transparency of a product formula. Titanium Dioxide also absorbs, reflects or scatters light (including ultraviolet radiation in light), which can help protect products from deterioration.

Titanium Dioxide is used to impart a whiteness to color cosmetics and personal care products that are applied to the skin (including the eye area), nails and lips, which it also helps to increase the opacity, and reduce the transparency of a product formula. Titanium Dioxide also absorbs, reflects or scatters light (including ultraviolet radiation in light), which can help protect products from deterioration.

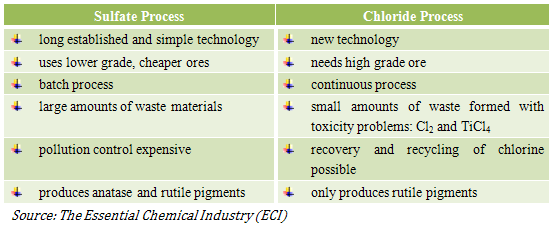

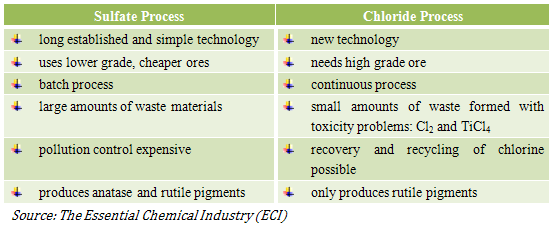

- TiO2 pigment is extracted from the raw feedstock with either sulfuric acid or chlorine. The chlorine process is the more advanced technology and is generally regarded as having a lower cost structure than the sulfate process. While the chlorine process has a higher raw ore cost due to using purer feedstock, the sulfate process has higher labor, waste and environmental liability costs. The chloride process is generally preferred for the major end uses in paint and plastics, and about two thirds of global capacity utilizes chloride.

- The overall chemistry of the two processes can be represented as:

- Comparison of the two processes for the manufacture of titanium dioxide.

- The global titanium dioxide industry has gravitated towards the Asia-Pacific region. In terms of supply, the titanium dioxide capacity of China has surpassed that of the US and hit more than 2 million tonnes, making China the world’s largest titanium dioxide producer. In 2011, the titanium dioxide output of China surged by 23.10% year-on-year to 1.812 million tonnes. Apart from the new capacity of 350,000 tonnes contributed by DuPont, any increase in titanium dioxide capacity is expected to come mainly from China in the future.

- This table shows the latest data of titanium dioxode production capacity in 2013, released by USGS.

- The industry has been plagued with overcapacity since the 1990s. TiO2 pricing in real terms fell close to 50% between 1990 and 2009. Due to the high fixed cost structure of the business, in periods of overcapacity producers cut prices in a desperate attempt to use up excess capacity.

- The last two decades have been marginally profitable at best for TiO2 producers, with plants often running at breakeven. However, overcapacity has persisted, in part due to the large environmental liabilities associated with decommissioning a TiO2 plant.

- TiO2 demand underwent a rare sequential decline in 2008-9, dipping by 8% globally and 16% in Western markets over those two years. Several producers responded by permanently shuttering higher cost plants constituting 7% of worldwide capacity. Additionally, many producers temporarily idled plants due to weak demand. These shutdowns, coupled with a rise in demand due to inventory restocking in the global recovery, led to tightening supply and sharply rising prices starting in the back half of 2009. Prices have risen consistently since then, with price increases for the third and fourth quarters of 2011 already announced by the major producers. While there is no uniformly agreed price index for the industry, based on industry data and public company reports prices have risen about 40% in the past year.

- The major question on the supply side is China. Ti Insight estimates that there are currently between 60 and 80 TiO2 plants in China with about 1 million mt of capacity, which is almost entirely sulfate capacity. Chinese producers have announced some significant capacity expansions, but there are doubts as to whether those plants will actually get built let alone whether they will actually run at their stated capacity. (DuPont has had a Chinese plant project stuck in the early planning stages since 2005.) Ti Insight estimates that China will add 770,000 mt of capacity by 2015. The consensus confirmed by both industry consultants and TiO2 buyers is that Chinese production is generally regarded as suitable only for lower-end markets and is not a substantial threat to Western producers at the present time. The sulfate process produces a lower quality base pigment than chloride. While sulfate TiO2 can be finished in a way that makes it comparable in quality to chloride, the finishing process is proprietary to each producer and the Chinese are not up to Western standards in that area. Only the top five producers possess chlorine technology and it is assumed the Chinese producers will have a tough time replicating it even if they attempt to do so. And even with the anticipated Chinese capacity expansions the total supply CAGR is only 3% through to 2015. That will probably just about keep up with demand growth.

-

About us

Contact us

Make a suggestion

- Metalpedia is a non-profit website, aiming to broaden metal knowledge and provide extensive reference database to users. It provides users reliable information and knowledge to the greatest extent. If there is any copyright violation, please notify us through our contact details to delete such infringement content promptly.

Titanium dioxide pigment (chemical symbol: TiO2) is an inorganic white pigment founded in a variety of end-uses, including paints (50%+ of global production), plastics (30%), and papers (5%). TiO2 possesses unique opacity and brightness characteristics with no cost-effective known replacement. Right now, TiO2 is the world’s most widely used white pigment accounting for more than 80 percent of global consumption.

Titanium dioxide pigment (chemical symbol: TiO2) is an inorganic white pigment founded in a variety of end-uses, including paints (50%+ of global production), plastics (30%), and papers (5%). TiO2 possesses unique opacity and brightness characteristics with no cost-effective known replacement. Right now, TiO2 is the world’s most widely used white pigment accounting for more than 80 percent of global consumption.

Titanium Dioxide is used to impart a whiteness to color cosmetics and personal care products that are applied to the skin (including the eye area), nails and lips, which it also helps to increase the opacity, and reduce the transparency of a product formula. Titanium Dioxide also absorbs, reflects or scatters light (including ultraviolet radiation in light), which can help protect products from deterioration.

Titanium Dioxide is used to impart a whiteness to color cosmetics and personal care products that are applied to the skin (including the eye area), nails and lips, which it also helps to increase the opacity, and reduce the transparency of a product formula. Titanium Dioxide also absorbs, reflects or scatters light (including ultraviolet radiation in light), which can help protect products from deterioration.