- 1. WTO: China rare earth caps 'break rules'

China is the largest producer of rare earth elements in the world.

China is the largest producer of rare earth elements in the world.- China's caps on exports of rare earth elements break global trade rules, the World Trade Organization (WTO) ruled.

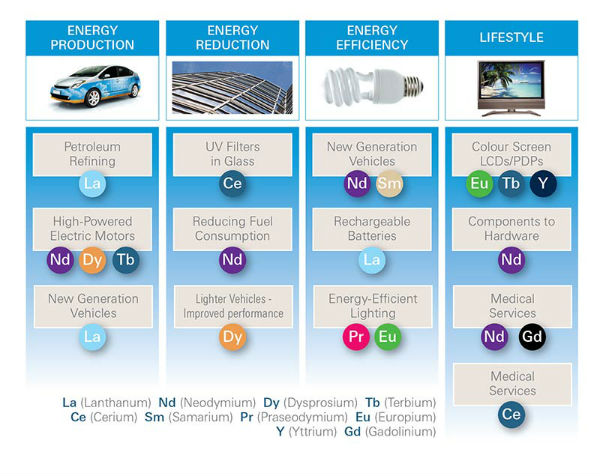

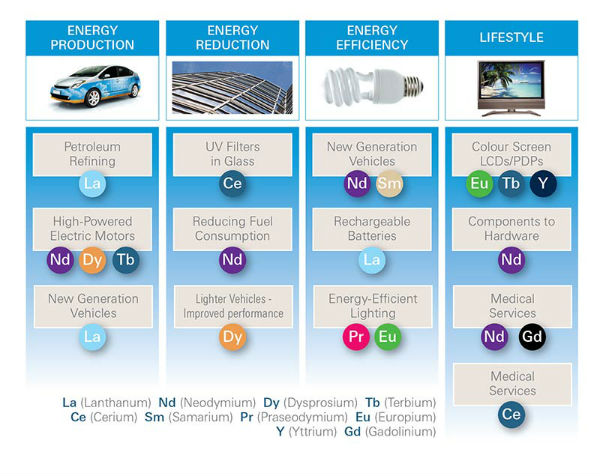

- Rare earths are used in gadgets such as DVDs and mobile phones, and China accounts for more than 90% of their global production.

- But it has put limits on their exports, which it says are aimed at reducing pollution and conserving resources. However, the organisation said the limits helped "secure preferential use" of the elements for domestic firms. In its ruling, the WTO said: "The overall effect of the foreign and domestic restrictions is to encourage domestic extraction and secure preferential use of those materials by Chinese manufacturers".

- "Accordingly, the panel concluded that China's trading rights restrictions breach its WTO obligations." 'Perfectly consistent'

- The demand for rare earth elements has jumped in recent years, triggered by growth in the number of high-tech gadgets being produced.

- These elements have unique magnetic and optical properties making them a crucial part of almost all modern-day equipment.

- Over the past decade the demand for rare earths has increased three-fold to nearly 125,000 metric tons a year.

According to some estimates, the figure could cross 200,000 tons this year.

- However, there have been concerns that mining and processing these elements generates toxic waste and impacts the environment.

- As a result, many countries that have rare earth resources have imposed restrictions on their mining, making China the biggest global supplier.

- Over the past few years Beijing also imposed its own set of limits on the sector, citing similar concerns.

- In a response to the WTO ruling, China's trade ministry said: "The Chinese government has been reinforcing and improving its comprehensive regulation on high-polluting, high-energy-consuming and resource-consuming products in recent years".

- "China believes that these regulatory measures are perfectly consistent with the objective of sustainable development promoted by the WTO."

- However, China's restrictions saw prices of these elements surge, prompting the US, European Union and Japan to lodge a complaint with the WTO.

- After the ruling, Michael Forman, US Trade Representative, said: "China's decision to promote its own industry and discriminate against US companies has caused US manufacturers to pay as much as three times more than what their Chinese competitors pay for the exact same rare earths."

- Beijing, which has 60 days to appeal against the ruling, said it was assessing the report.

- Source: BBC News

- 2. Kenya’s $100 billion hidden mineral deposits

- Kenya’s profile as a potential top rare earth minerals producer rose a rung higher after mineral explorer Cortec announced it had found deposits worth $62.4 billion.

- Mrima Hill, in the coastal county of Kwale, has one of the top five rare earth deposits in the world. The area also has niobium deposits estimated to be worth $35 billion.

- “This is by far the largest mineral deposit in Kenya and the find at Mrima Hill will make Kenya one of the largest rare earth producers in the world,” said David Anderson, managing director of Cortec Kenya Mining.

The Kenyan government will earn three per cent royalties from the niobium project and five per cent from the rare earths mining. Under the Constitution, 80 per cent of these earnings will go to the central government, 15 per cent to Kwale County and five per cent to local residents.

- A global scarcity of rare earth in a market largely controlled by China has kept prices high, with Japan, which accounts for a third of all global demand, hard-hit by scarcity and looking to diversify its supply sources.

- China has been supplying 90 per cent or more of the world’s rare earth minerals for over a decade, but it is also the largest consumer (72 per cent in 2012).

- Cortec, which holds the mining licence for Mrima Hill, has also confirmed a deposit of 680 million kilogrammes of niobium, held in 105 million tonnes at 0.7 per cent niobium pentoxide.

- The global demand for niobium, used to strengthen steel, is rising rapidly, with Mrima Hill now positioned in the world’s top six deposits.

- Kenya is poised to join Tanzania as a rare earth supplier. In March, Tanzania announced the discovery of lower grade deposits within the Wigu Hill Rare Earth Project located 170 km south-west of Dar es Salaam.

- Source: www.theeastafrican.co.ke/news/Kenya-hits-USD100-billion-rare-earth-jackpot-/-/2558/1920964/-/r128daz/-/index.html

- 3. Samsung investing in rare earth alternatives

- Our phones wouldn't be the same without rare earth elements: they're found in our LCD display screens, the motors that make our phones vibrate, the speakers – all that to make our phones small and awesome.

- Other technologies also depend on REEs: microphones, TVs, electric and hybrid vehicles, headphones, X-ray machines … the list goes on.

- But the problem with these materials is that more than 95% of our supply comes from China, putting some tech companies and other users at the mercy of Chinese suppliers.

- South Korea's Samsung is looking for alternatives. Through its Future Technology Cultivation Project, the massive manufacturing conglomerate plans on financing 27 projects, including research on materials that can substitute the use of rare earths, ZDNet reports.

- Unveiling the plans last week, Samsung said it would invest in seven areas of research into new materials.

- When China announced that it would restrict REE supplies in 2010, car manufacturers began looking for other options. At the time, Jack Lifton, co-founder of Technology Metals Research, said that the industry would "engineer this stuff out." And indeed, in 2012 Hitachi introduced an energy-efficient motor that doesn't use rare earths.

- Source:www.mining.com/samsung-investing-in-rare-earth-alternatives-47617/

-

About us

Contact us

Make a suggestion

- Metalpedia is a non-profit website, aiming to broaden metal knowledge and provide extensive reference database to users. It provides users reliable information and knowledge to the greatest extent. If there is any copyright violation, please notify us through our contact details to delete such infringement content promptly.

China is the largest producer of rare earth elements in the world.

China is the largest producer of rare earth elements in the world.