- Rare earths: resource distribution and production

- Source: http://phys.org/news/2012-07-china-stockpiling-rare-earths.html

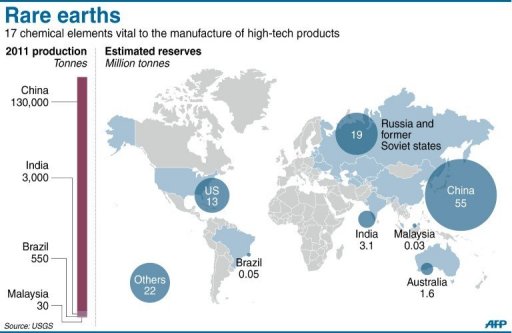

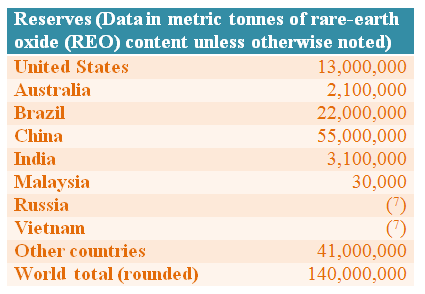

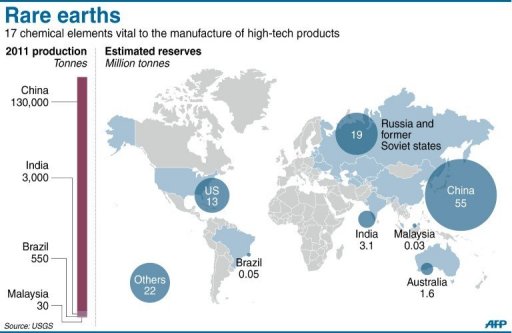

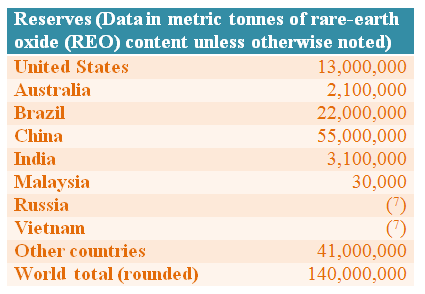

- Rare earth minerals occur in the form of bastnaesite, monazite and xenotime and some other minerals. As shown in the U.S. Geological Survey, Mineral Commodity Summaries, February 2014, REE reserves worldwide total 140 million tonnes. They are distributed mainly in China (55 million tonnes), the United States (13 million tonnes), India (3.1 million tonnes), Australia (2.1 million tonnes), Brazil (2.2 million tonnes), Malaysia (30,000 tonnes), Russia, Egypt, Canada, South Africa and other countries.

- The original data on reserves is as follows:

- Source:Rare earths-U.S. Geological Survey, Mineral Commodity Summaries, February 2014

- The data which appeared in “The Rare Earth Situation and Policy of China” (2012) is different from that of the United States Geological Survey (USGS), and it is said the reserves in China account for 23% of the worldwide total, which in 2009 was equivalent to 18.59 million tonnes.

- Different rare earth minerals are distributed across the following countries:

- China

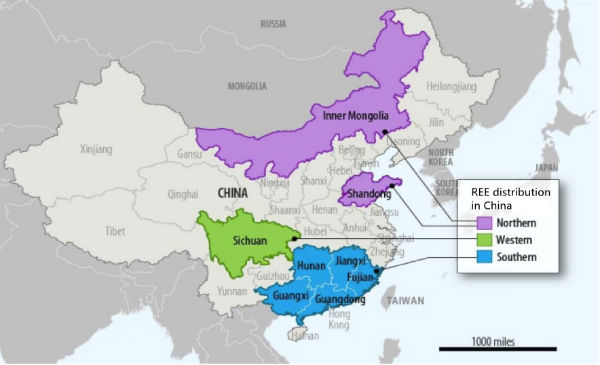

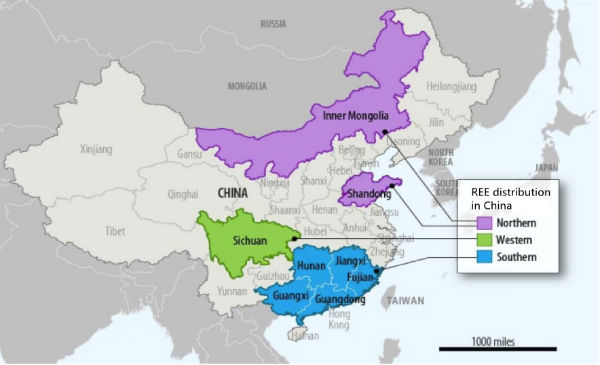

- The reserves of rare earths in China are particularly abundant, accounting for 23% of the total reserves in the world. The country is rich in both light rare earth elements and heavy rare earth elements, mainly in the form of bastnaesite and monazite, as well as some ion-absorbed deposits and xenotime. The reserves are distributed mainly in Inner Mongolia, Jiangxi, Guangdong, Sichuan and Shandong provinces, whose total rare earth resources account for 98% of the overall figure in China. In particular, Ganzhou in Jiangxi province has been named the Kingdom of Rare Earth and Baotou in Inner Mogolia, the City of Rare Earth.

- Source: web.mit.edu

- United States

- The United States is one of the countries containing the greatest abundance of rare earth minerals, mainly bastnaesite and monazite. As by-products, the black thin gold yttrium, silicon, beryllium ore and phosphorus ore can also be collected. These minerals are distributed mainly in California, Florida, and parts of North Carolina, South Carolina, Georgia, Idaho and Montana. It is estimated that if 87 large rare earth mines were restarted, their production could meet the total commercial demand in the world for 280 years.

- Russia

- Rare earth minerals are also rich in Russia, with USGS reporting in 1993 that its reserves were 19 million tonnes. However, in recent years the figure is unknown. In May 2013, it was reported that Russia was going to develop the Tomtor Rare Earth Mine in its Far Eastern region, in which the rare earth reserves may reach around 150 million tonnes, including yttrium and niobium oxide, scandium and terbium. It was claimed the reserves at Tomtor may form up to 12% of the total world resources with the proven reserves numbering approximately 154 million tonnes.

- India

- Rare earth minerals in India mainly exist in the form of monazite and monazite distributed in coastal placers and inland placers. In 2012, Indian Rare Earths Ltd decided to restart a large rare earth development project in Orissa. Senior officer Shailesh Nayak from the Ministry of Earth Sciences explained that the mine covered an area of 2500 square kilometers, and all possessed primary ore.

- Australia

- Australia is rich in monazite, which is concentrated in the western area. There are also xenotime, uranium tailings from central Queensland and copper, uranium and gold deposits from South Australia.

- Canada

- Rare earth elements are collected from uranium mining, which is located in Ontario province. In addition, potential rare earth resources also exist in pyrochlore ores in Quebec province. Some ores containing yttrium and heavy rare earth elements exist in Newfoundland and Labrador provinces. It was reported by Quest Rare Minerals Ltd that they had discovered rich rare earth mineral deposits in Northern Quebec in Oct, 2013. The annual production of REO ore concentrate is 13,650 tonnes in Canada. It is believed that Canada is a potential world REE supplier.

- Malaysia

- Malaysia was once the main source of heavy rare earth elements and yttrium in the world. The country hosts a collection of rare earth minerals, including monazite, xenotime and samarskite from tin ore tailings.

- Egypt

- Egypt is rich in monazite, which is collected from ilmenite in the Nile Delta.

- Brazil

- Brazil was one of the first countries to produce rare earth elements and was once well known for it across the world. It began to export monazite to Germany as early as 1884. The monazite is mainly concentrated along the east coast, from Rio de Janeiro to Fortaleza. In recent years, maitlandite, bastnaesite and cerium within brown stone, as well as other important rare earth deposits have been discovered in MoLuDu FeiLu.

- South Africa

- South Africa is another country that is a very important producer of monazite. The apatite mine containing monazite is located in Kamps Wilson, Cape Province and is the only single-vein type monazite mine in the world. In addition, on the east coast at Richards Bay the coastal placer also contains rare earths and in buffalo fluorite ore which is associated with monazite and bastnaesite, mining and recycling is drafting a plan.

- Afghanistan

- USGS reported in 2011 that the biggest rare earth mineral deposits, including lanthanum, cerium and neodymium, may have been discovered under an extinct volcano in southwestern Afghanistan. It is estimated that the reserves could probably supply the whole world for 10 years, and their value is up to £ 53 billion. As the deeper formation of the earth has not been explored, the actual reserves will be far more than so far estimated.

- Main REE producing country: China.

- Main REE consumption countries: China, the United States, Japan, Korea and some countries in the European Union.

- Main REE exporting country: China.

- Main REE importing countries: the United States, Japan, Korea, Russia and some countries in the European Union.

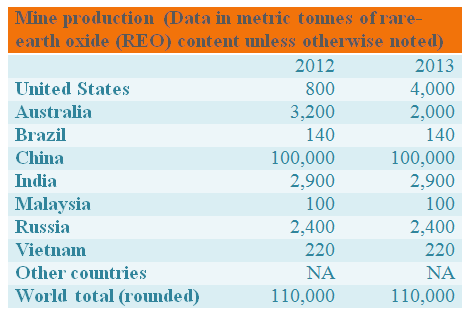

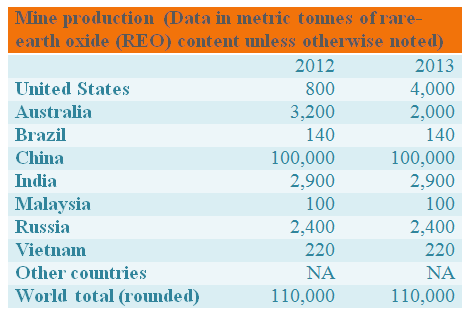

- The figures of REE mine production reported by the United States Geological Survey (USGS) in 2014 were as follows:

- Source: Rare earths-U.S. Geological Survey, Mineral Commodity Summaries, February 2014

- Rare earth resources supply

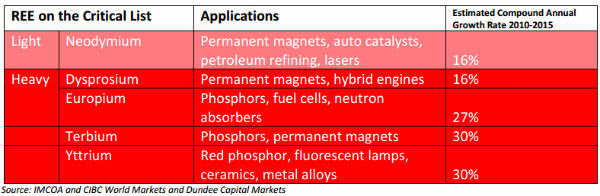

- REE on the critical list

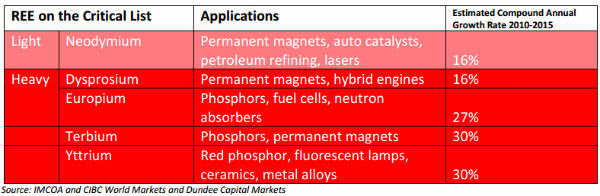

- In 2010, The U.S. Department of Energy classified the five REEs critical to some markets to be in short supply. Four of these are the HREEs. China’s Ministry of Commerce has indicated that China’s HREEs could be depleted in the next 15-20 years.

- These minerals, with the exception of Yttrium, are expected to be in short supply over the next 10 years. The magnitude and duration of these shortages will mainly depend on the success of REE exploration projects. Various governments and industrial users worldwide have begun to develop strategies to safeguard their REE supplies in order to overcome future supply problems. Some industrial users have established joint ventures with mining companies. Market mechanisms should ensure serious shortages are averted in the long term. This supply gap has led to increasing attention from governments, exploration companies and end users.

- Source: http://www.iamgold.com/files/REE101_April_2012.pdf

- Currently, China is the major supplying and exporting country for REE, providing nearly 90% of REE consumed in the world. However, due to the heavy consumption of these REE resources over a long period, the environment has been severely damaged. Serious environmental problems, including vegetation degradation, soil and water loss have occurred in China. China’s Ministry of Commerce has indicated that the country’s HREEs could be depleted within the next 15-20 years. Taking these problems into consideration, China has adopted measures domestically to govern the REE industry year by year and maintain and support its healthy and sustainable development. In addition, the government has announced regulations and policies covering exports and a crackdown on smuggling. The yearly export quotas in force between 2008-2013 were: 34,156 tonnes (2008); 31,310 tonnes (2009); 24,280 tonnes (2010); 30,184 tonnes (2011); 30,996 tonnes (2012); and 31,001 tonnes (2013).

- In March 2012, the U.S., E.U. and Japan confronted China at the WTO about these export and production restrictions. The WTO was to deliver its findings at the end of Nov. 2013, and advise China to correct any inappropriate behavior relating to the restrictions.

- The WTO ruled on March 26th, 2014 that China had acted inconsistently with WTO rules with regards to the export measures imposed on the rare earth materials.

- While the regulations have been in place in China, the market supply has decreased and many countries have begun looking for REE in other countries, as well as for alternative materials to replace REE.

- The alternative countries include Australia, Brazil, Canada, South Africa, Tanzania, Greenland and the United States. For example, the Mountain Pass mine in California, Nolans Project in Central Australia, Hoidas Lake Project in northern Canada and Mount Weld Project in Australia all have plans to supply part of the worldwide demand. A large deposit of rare earth minerals was recently discovered in Kvanefjeld in southern Greenland. Meanwhile,Vietnam signed an agreement in 2010 to supply REE to Japan. Some other projects are also being considered, such as Thor Lake in the Northwest Territories of Vietnam, a site in southeastern Nebraska in the US, etc.

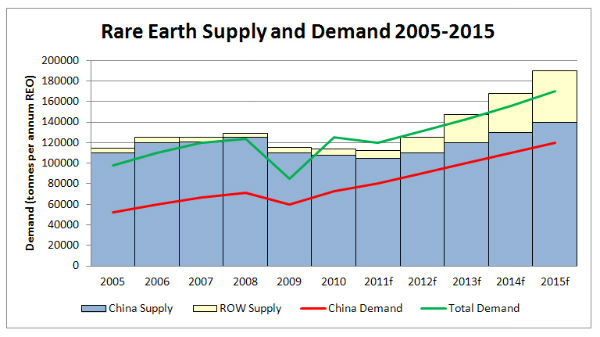

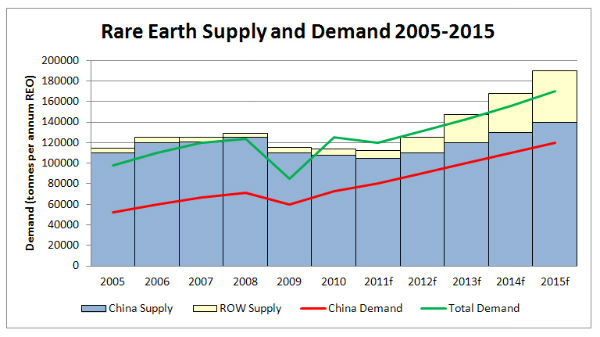

- Rare earth supply and demand 2005-2015

- Source: http://www.pgm-blog.com/2013/07/

-

About us

Contact us

Make a suggestion

- Metalpedia is a non-profit website, aiming to broaden metal knowledge and provide extensive reference database to users. It provides users reliable information and knowledge to the greatest extent. If there is any copyright violation, please notify us through our contact details to delete such infringement content promptly.